Repaying Your Help to Buy Loan: How to Prepare Financially and Legally

Many homeowners, and especially working parents with little spare time on their hands, find repaying their Help to Buy loan confusing once the initial support fades. Whether you’re planning to sell, remortgage, or pay off the equity loan, knowing exactly what to do can make the difference between a smooth transaction and a stressful one.

The process can seem daunting at first, but once you understand each step, it becomes far easier to manage. So, if you want to save some time and money to spend on the kiddos, keep reading to learn how to prepare both financially and legally so you can complete your repayment with confidence.

Understanding How Help to Buy Loan Repayment Works

Your Help to Buy loan was designed to make home ownership more achievable, but it isn’t a permanent arrangement. You’ll need to repay it either when you sell your home, after 25 years, or sooner if you decide to clear it early. Many people choose early repayment to regain full ownership and reduce the amount owed as property values rise.

The repayment is always based on your home’s current market value, not its original purchase price. So, if your property’s worth has increased, your repayment will rise too. For clear, expert guidance on every stage of your Help to Buy loan repayment, you can rely on SAM Conveyancing for practical advice and trusted solicitor support to ensure the process is handled correctly and efficiently.

Preparing Financially for Repayment

Financial preparation starts with understanding exactly how much you owe. To do this, you’ll need a RICS-qualified surveyor to provide an independent valuation accepted by Homes England. This valuation confirms your home’s market value and determines your repayment amount.

Once you receive the valuation, you must contact Homes England’s Post Sales Team to request a redemption pack, which includes the exact amount to be repaid and any administration costs. If you’re using savings, make sure the funds are available in time for completion.

It’s also important to consider associated fees such as legal costs, surveyor charges, and possible remortgage arrangement fees. Building these into your budget early helps you avoid last minute financial pressure and ensures a smoother process overall.

Managing the Legal Steps of Repayment

The legal side of repayment is just as important as the financial preparation. You’ll need a conveyancing solicitor to handle all formalities and communicate with Homes England’s legal representatives. Your solicitor will review your title deeds, verify your loan terms, and arrange for the funds to be transferred securely upon completion.

If you’re selling your property, repayment usually happens as part of the sale. The solicitor will ensure Homes England’s charge is cleared from the sale proceeds before the transfer completes. If you’re remortgaging or repaying directly, your solicitor will coordinate the payment and issue a Form of Undertaking to Homes England, confirming that funds will be sent once they’re released by your lender.

Planning Early to Avoid Costly Delays

Timing is everything when repaying your Help to Buy loan. Valuations are only valid for three months, so arranging one too early could mean needing a new report if your repayment takes longer to complete. Always check Homes England’s processing times, as they can vary depending on demand.

We all know it can be hard to find the time between work and childcare, but keeping communication open with your solicitor, surveyor, and lender ensures there are no surprises or delays. If you’re unsure about any stage of the process, ask questions early.

A Confident Step Towards Full Ownership

Repaying your Help to Buy loan doesn’t have to be overwhelming. With the right preparation, you can manage both the financial and legal steps smoothly and regain complete control of your property.

Once the process is complete, you’ll have peace of mind knowing that your property investment is fully under your name and free from future equity loan obligations. This milestone not only strengthens your financial independence but also marks a major achievement in your home ownership journey.

Introducing Amanda Marks

We’re thrilled to welcome our new columnist Amanda Marks. Amanda is a Renowned Breastfeeding, Food & Sleep Consultant

With over 40 years of experience supporting families, Amanda Marks is a highly respected breastfeeding, food, and sleep consultant. Based in prestigious locations including 10 Harley Street, London, and Alderley Edge, Cheshire, Amanda has worked with families from diverse backgrounds, including media personalities and royalty, maintaining the highest standards of confidentiality.

An Interview with English Professional Boxer Chris Billam-Smith

At BROOD, we’re always drawn to stories that celebrate not just professional triumphs, but the heart and humanity behind them. Someone who embodies this spirit perfectly is Chris Billam-Smith—a world-class athlete

whose grit in the ring is matched only by his devotion to his family.

Why Family Gardening Is Having a Quiet Comeback

There’s a noticeable shift happening in how families spend their time. It isn’t loud or trend-led, and it’s rarely documented with before-and-after shots. Instead, it’s quieter and slower, rooted in small routines and shared moments. Family gardening is part of that change.

From Parliament to the Premier League: Campaigning for survivors of domestic abuse during this #16DaysOfActivism

Our Head of Social Causes and Sub-Editor Teresa Parker was joined by BROOD Editor-in Chief Lolo Stubbs at an event in Parliament on the 2nd December 2025 to mark ten years of coercive control legislation. Teresa organised the event through her consultancy Teresa Parker Media, in partnership with Hawkins, Laxton & Co, which is run by her former colleagues Clare and Sian.

WHY PARENTS NEED A WILL (Even If You Don’t Think You Do)

A lot of people still think wills are only for the wealthy or the elderly. I hear this all the time. In reality, wills are about far more than dividing up money.

Learning to let go – the empowerment edit with Sarah Jayne Dunn

Have you ever found yourself in a situationship that doesn’t serve you? You’re not sure why, you can’t quite put your finger on it, but deep down, something doesn’t feel right. Your gut is nudging you, your heart feels heavy, the energy is off, and somewhere in the background, the alarm bells are starting to ring.

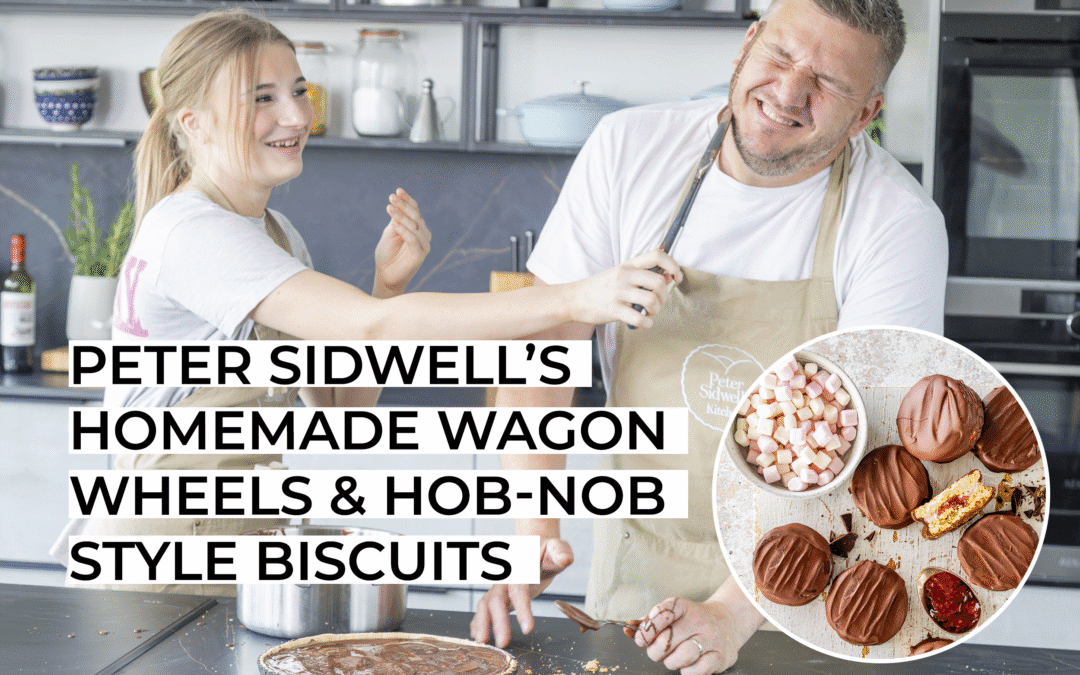

PETER SIDWELL’S HOMEMADE WAGONWHEELS & HOB-NOB STYLE BISCUITS

This month, I’m thrilled to share two of our all-time favourite bakes: our homemade Hob Nobs and nostalgic Wagon Wheels. These recipes are more than just sweet treats—they’re time capsules. The Hob Nobs came from a rainy weekend when we had oats, butter, and not much else in the cupboards. The kids loved rolling the dough into little biscuit balls and watching them flatten in the oven. Dipping them in chocolate was the final touch—well, that and licking the spoon clean!

Building a Brand from the Kitchen Table

Mum-of-two Megan Ford shares how family life, late nights, and a passion for purposeful play sparked the beginnings of Ellor & Co — proving that big dreams really can start at the kitchen table.

a wave of light: Honoring little lives lost

Honoring Little Lives Lost October 9–15 marks Miscarriage Awareness Week, a time to remember and honour all the little lives lost too soon. Having experienced the pain of pregnancy loss myself, I see this week differently now. It is not really for those of us who have...

Marcus Bean’s – Chicken, basil pesto & courgette risotto

Once you master the basics of risotto, the options are endless. To make it easier on busy weekdays, you can

make the base in advance, then finish it off just before serving